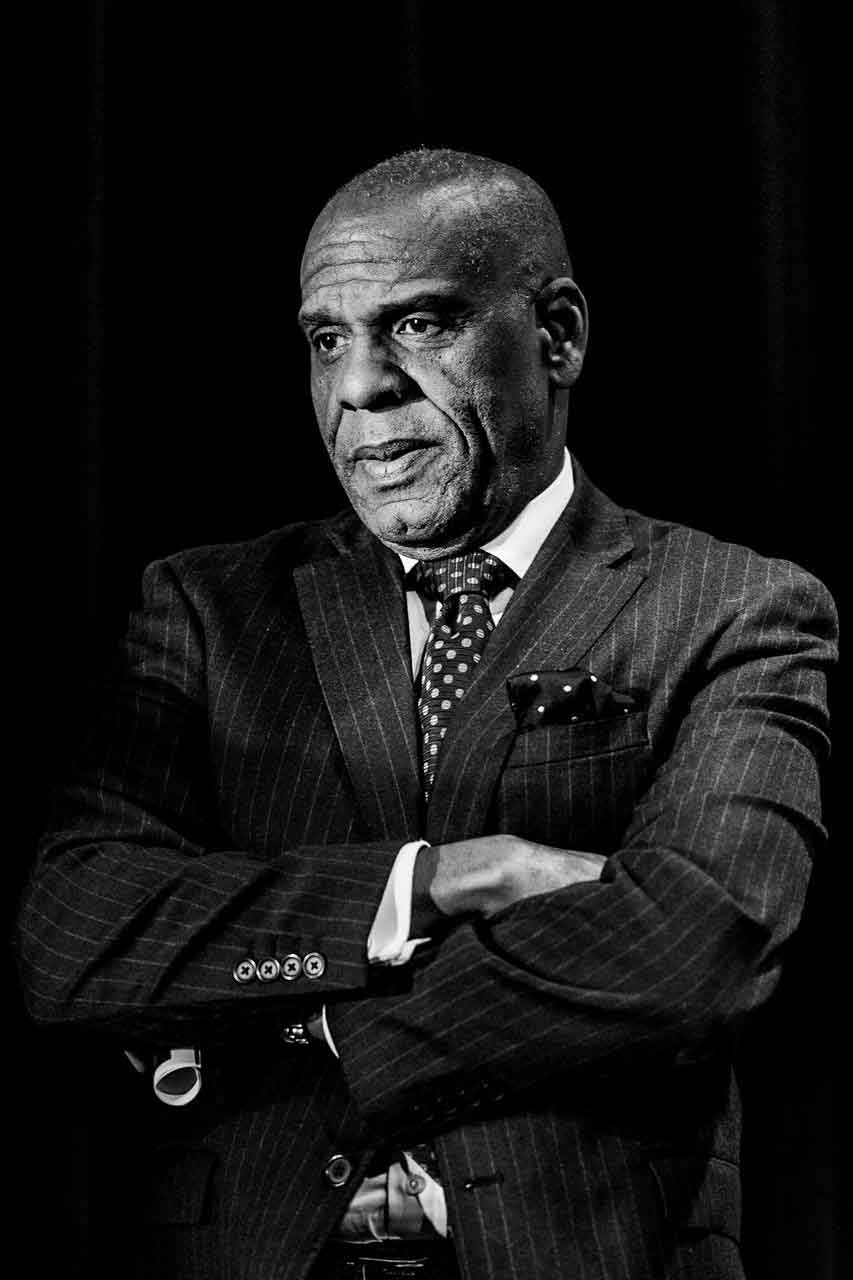

Interview: Former Sen. Steven Bradford Explains Why He’s Running for Insurance Commissioner — Not Lieutenant Governor

Former California Sen. Steven Bradford (D- Inglewood) surprised some Sacramento political insiders late last Month when he withdrew his candidacy for Lieutenant Governor and announced his new campaign for State Insurance Commissioner.

By Edward Henderson | California Black Media

Former California Sen. Steven Bradford (D- Inglewood) surprised some Sacramento political insiders late last Month when he withdrew his candidacy for Lieutenant Governor and announced his new campaign for State Insurance Commissioner.

A longtime public servant, Bradford previously served in the California State Senate for eight years. Bradford – former chair of the Senate Energy, Utilities and Communications Committee — authored and championed laws covering a range of issues, including healthcare, public safety, energy, communications, education, economic development and revitalization. While in the Legislature, Bradford also served on the Insurance Committee, writing and supporting legislation aimed at making California’s insurance more equitable, accountable and accessible.

Bradford’s bid for Insurance Commissioner is happening at a time when there is increasing instability in California’s insurance sector. A number of insurers – including major providers like State Farm and Allstate – have exited the state or scaled back their coverage, citing the high cost of doing business in the state and overregulation of the state’s insurance market. This trend has led to a shrinking private insurance market, particularly for homeowners in high-risk fire zones.

As a result, more Californians are signing up for the Fair Access to Insurance Requirements (FAIR) Plan, the state’s safety net insurance program for homeowners who can’t find fire insurance elsewhere. Enrollment in the FAIR Plan has surged, placing additional strain on the system and raising concerns about long-term sustainability.

Bradford has positioned himself as a reform-minded candidate focused on restoring stability to California’s insurance market. In a recent interview with California Black Media (CBM), he discussed the factors that led to his decision to run for Insurance Commissioner, his plans to address high insurance prices and his advocacy for racial equity and reparations.

You have raised more than half a million dollars for your candidacy for Lt. Governor since you announced in 2024. Then, late last month, you announced that you are running for State Insurance Commissioner instead. What led you to make the switch?

It was a combination of things. The fire in Altadena and surrounding areas in Los Angeles and the Palisades was one. The number of calls that I’ve received from residents saying, “Hey, we’re in a crisis situation, Steve.” You have a skill set that we feel could bring folks together. You’ve demonstrated that as a utility chair, bringing in consumer groups, regulatory and the utilities companies themselves, having straight talk with these folks, and that’s what’s needed right now, trying to bring everybody together.’ I’m honored that they feel I have the skill set to do this.

It wasn’t an easy decision for me. It took a whole lot of conversation and even more prayer before I decided to go.

If you win the race for Insurance Commissioner, what would be the first thing you do to improve the relationship between the state and insurers and what would you do to persuade insurance companies with plans to leave the state to stay?

First, bring everybody in the room. You’ve got to have a good dialogue. You’ve got to understand what those challenges are that are driving them out and preventing them from providing insurance, and at the same time, finding out what are those pinch points for consumers where they say, “Hey, I can’t no longer afford this.” And I’m not going to sit here and say I have all the answers because it’s going to require me to surround myself with experts that know more than me. And far too often, you hear elected officials say what they’re going to do on day one. I’ve been elected long enough to know being elected does not come with a magic wand.

As more Insurance companies leave California, does the state have enough money to sustain the state-funded FAIR plan for homeowners?

It’s a challenge there; it’s about a billion dollars short right now. There was a piece of legislation that was going through last year and I think they brought it back this year by I think Assemblymember Calderon who is trying to allow the fair plan to bond and raise funds if there’s a shortage. So, if that piece of legislation passes, it will help greatly in being able to monetize and pay for the program.

California has the highest insurance rates in the country. A lot of people in the communities we serve complain that insurance rates are too high and information about coverage is not straightforward and accessible enough. Do you have plans to dress these concerns?

That’s part of the whole discussion of bringing consumers into a room and bringing the industry into a room, understanding what those costs are, what’s driving those costs. But we’ve got to be honest about it. California has some of the most expensive real estate in the country — if not in the world. So, it’s going to cost more to insure it than it would, say, somewhere in Iowa.

When you were in the State Senate you served on the Reparations Task Force. In terms of policy, are you still engaged in advancing the recommendations the task force made to the Legislature?

Without a doubt. I’ve been talking to community groups. I just did an interview with a news agency last week. I’m constantly being asked what my opinion is and how I think things are going. There are some challenges there but we still have to keep moving forward and trying to stand up for some of those 115 recommendations in the reparations task force report. And one of the things I learned personally during that task force was what role insurance played after slavery and the fact that many Black folks couldn’t get insurance. So, it was part of the reparations discussion as well.